The “Science” of Economics

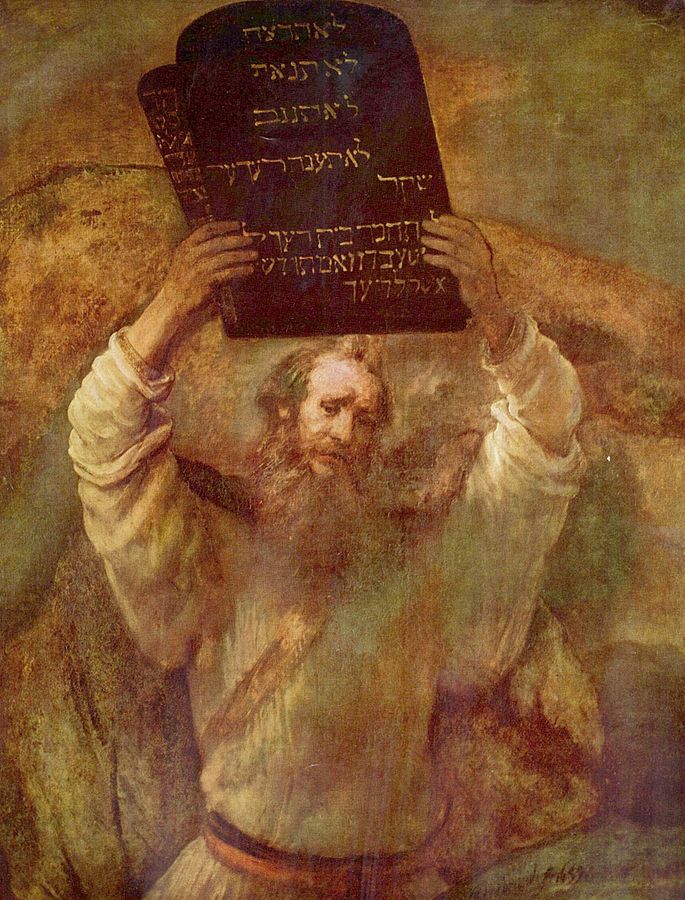

A modern day view of economists.

By Rembrandt – The Yorck Project: 10.000 Meisterwerke der Malerei. DVD-ROM, 2002. ISBN 3936122202. Distributed by DIRECTMEDIA Publishing GmbH., Public Domain, Wikimedia Commons

The other day I was exchanging comments with a reader on the post The Political Defense of US Capitalism, when I was struck by a particularly insightful remark of his. He wrote

For all your models, you must know that economic science is to some degree a guessing game, and that the only certain way to figure out what works is to try it …

The context in which he wrote this sentence is not important for my present purposes. What is important is his observation so-called “economic science” is “to some degree a guessing game.”

The Level of Economic’s Development

One immediate rejoinder of someone who had great faith in “economic science” could be that all sciences proceed as guessing games with a guess being dignified with the title of “hypothesis”. Trying to figure out what works by trying it is called an experiment.

With the “science” of economics, however, the scientist must proceed with the greatest of caution in experimentation, because the welfare of millions, perhaps even billions of people depend on the outcome of his/her experiment. Economic experiments are particularly fraught with peril. It can not be viewed as a highly developed science in the way physics, chemistry, and even biology can. Although economists write down many equations, these equations are often based on flimsy ad hoc assumptions. Many times they are based on observations that are true under limited circumstances that are ill-understood. An example of this last situation on which I have written recently is the Keynesian Phillips curve.

Economics is not a highly developed discipline like physics, in which one might always with confidence derive an expression from a law that is universal or whose limitations are well known. Instead, economics today is more like Newtonian physics, having found only the most basic of the laws governing human systems of producing and distributing wealth. The level of development we really need is that of physics in the late nineteenth and early twentieth centuries.

In fact the part of physics that resembles economics the most is statistical mechanics, which describes many-body systems with an arbitrary number of interacting particles. Of course the “particles” in an economic system are what are called economic agents: individuals or groups of individuals, such as companies, that buy and sell goods and services. Although an economy’s interacting particles are considerably more complicated than those in a physical many-body system (as any novelist can tell you), the comparison of an economy with a statistical mechanical system gives us a very big hint: We can possibly average over the ensemble of interacting economic agents to get relations on which we can depend. If you read much science fiction, you may recall Isaac Asimov used this idea of a statistical mechanics of human sociological systems to great effect in his classic Foundation novels. Unfortunately, such a statistical mechanics of economies remains science fiction for us today. Nevertheless, as I wrote in Central Planning for Chaotic Social Systems and in How to Solve Problems in Chaotic Social Systems, the analogy between chaotic many-body systems and human economies shows us why free-market systems work considerably better than socialist ones.

What Are the Economic Laws we can Depend On?

I claimed in the last section economics is roughly at the same level of development as physics was after Newton’s amazing contributions. In writing that, however, I might have been just a tad optimistic. Newton discovered the time-rate of change of a body’s momentum was equal to a force (his second law of motion), and using the form for the gravitational force he discovered, he could calculate the trajectory of a body moving under the influence of gravity. Once a physicist knows the dynamics of individual particles in a many-body system, he can use this knowledge in statistical mechanics to describe, among other things, the densities of different species of particles as time-varying fields.

It is the dynamics of the “particles”, the economic agents in the system, that we lack. We may know the dynamics under limited conditions, but how they develop under all situations eludes us. Nevertheless, we do know the analogues to Newton’s laws of motion. For an economic system, they are the law of supply and demand and the law of marginal utility. The dynamics we need are of the quantities and prices of goods and services, i.e. we need to know how they change. We know the basic dynamics in the limited case of free-markets, which are described by the mechanisms labeled with the metaphor of Adam Smith’s invisible hand.

To push the analogy with statistical mechanics a bit further, let me suggest the following possibilities for the future. If we could use supply and demand and marginal utility to suggest accurate expressions for the time rates of change of quantities and prices for goods, we could then develop an exact analogue for Liouville’s theorem and for the Boltzmann equation in statistical mechanics. The distribution functions in those equations would be for the densities of buyers and sellers of goods in the “phase space” described in How to Solve Problems in Chaotic Social Systems. This is a project for the future, which as far as I know has yet to be attempted.

Is there anything else upon which we can generally depend? Say’s law of markets certainly provides a better, indirect way for governments to stimulate an economy hit by recession than the direct, disaster prone Keynesian stimulus. Read Say’s Law of Markets and Further Thoughts on Say’s Law for a more general discussion. Depending on the free-market to stimulate the economy does not have the danger of unbalancing existing supply and demand relationships the way a government Keynesian stimulus has. A government can help Say’s Law to work its magic by eliminating any government regulations unduly restricting economic activity and by lowering taxes.

There is yet one more economic law we can depend upon, and that is the only economic law that can actually be derived by a mathematical proof: Ricardo’s law of comparative advantage. To see the proof, click here to view a PDF holding it. So long as a country has a comparative advantage in producing a good over a second country, it will be profitable for both countries if the first country with the comparative advantage sells the good to the second country. This seems to be a bit of economic wisdom that has been lost on both Donald Trump and Bernie Sanders. What people usually complain about are transient effects of foreign trade made unduly long by government restrictions slowing private sector adjustments to eliminate those effects. Read the post on The Trans-Pacific Partnership for more on this.

The Ethical Conduct of Economic Experiments

Because the potential for great harm is present with any economic experiment, experiments conducted by governments should be avoided if at all possible. By definition, a federal government experiment would involve the entire economy at once and could cause catastrophe for the entire economy. If a government experiment is for some reason absolutely necessary, in the U.S. it would be far better if the experiment were conducted by state or local governments. Then the other states and the federal government could observe the results, and if the local experiment is successful, the reform could be adopted more widely.

Best of all would be experiments run by individual companies. This limits the possibility of harm, and since they are conducted by the people most knowledgable in what makes their business work, maximizes the probability of success. Companies would not enter an experiment if there were a good chance to harm their economic health.

Economists and politicians should be required to take some version of the Hippocratic oath. With the economy they should first do no harm.

Economic Analysis and Data

Given computers and the internet, we are blessed today in the amount and the universal availability to all of economic data. In particular, here in the U.S. any citizen with a computer and access to the internet has available to him/her a vast array of data from the Federal Reserve system. The St. Louis Federal Reserve District bank makes this data available in their Federal Reserve Economic Database (FRED). You can find a tutorial on how to use it from NYU’s Stern School of Business here. With many people being able to seriously think about the way economic systems work, we can expect (I think and hope) to push economics more toward the status of an advanced science.

Views: 2,830

I just wanted to thank you for the great post. One of my unpublished blog posts is dedicated to the idea that economics is destined to become a hard science, like physics, and it’s great to see you compare the development of the two fields.

Thank you for the complement! I hope the post gives you ideas to exploit.