If Hillary Clinton Were President …

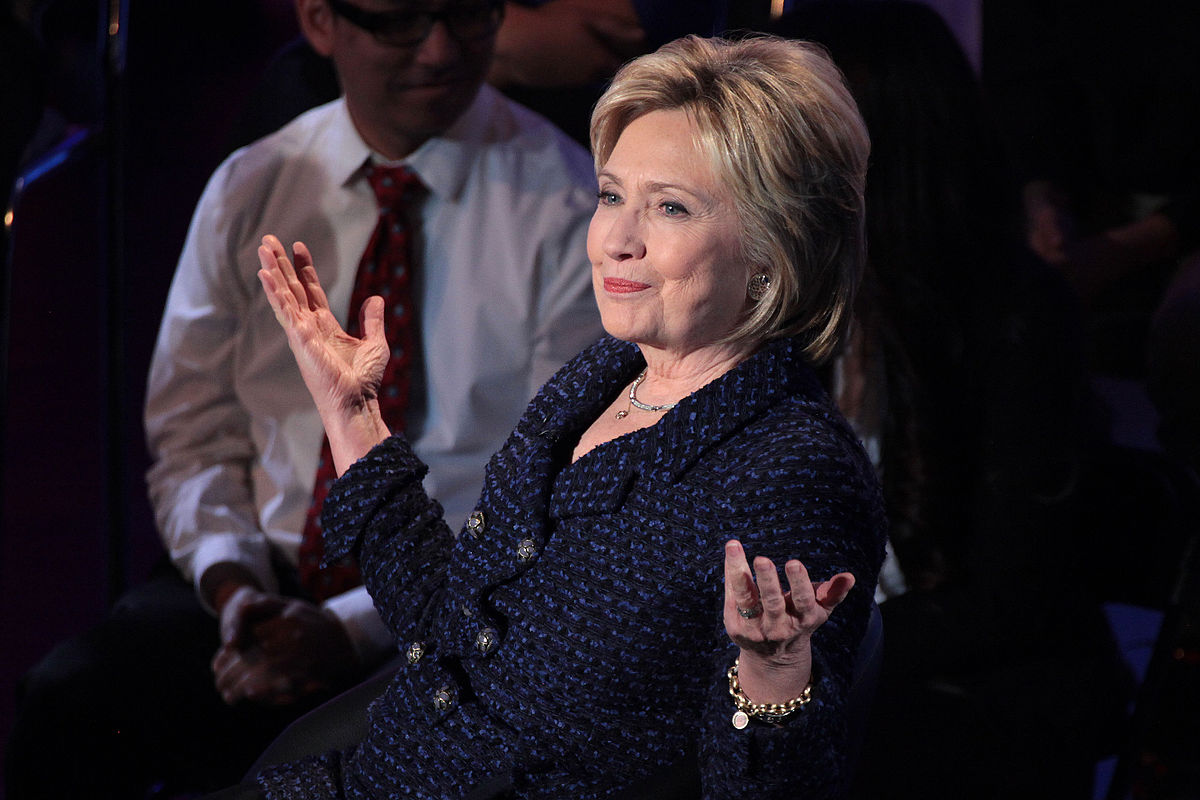

Hillary Clinton speaking at the Brown & Black Presidential Forum in Des Moines, Iowa on January 11, 2016

Wikimedia Commons/Arthur Skidmore

Given how the bombastic Donald is increasingly sabotaging his own cause by opening his mouth, “crooked Hillary” in the photo above may very well end up as our President (heaven forfend!). It would then be a very useful exercise to imagine what a Clinton administration would mean in terms of the policies she favors.

Hillary Clinton’s Policies

Being a progressive Democrat, Hillary Clinton would be expected to offer policies that increase taxes and government intervention into the economy, while greatly increasing government expenditures. And Hillary does not disappoint!

First let us consider how much additional spending would result from all the new programs she is advocating. The Committee for a Responsible Federal Budget (CRFB) added up the bill, and came to an estimate of $1.8 trillion over a decade. They also stated that her plans included about $1.6 trillion in specified revenue offsets plus about $275 billion in unspecified offsets. Therefore, if Clinton is successful in getting both the proposed increased spending and increased revenue, the two would just about balance each other.

However — and this a pretty big “However”! —the CRFB also reported the following:

However, Secretary Clinton’s proposals fail to address our national debt, which will grow from a post-war record-high 74% of GDP last year to 86% of GDP by 2026.

The emphasis in the quote above belongs to the CRFB. [N.B. You might well recall that I have written that the U.S. national debt was over 100 percent of GDP. This is the figure you would get from the Federal Reserve Economic Database. It turns out that the amount of the debt held by U.S. citizens is the 74% of GDP quoted above. The remainder of the debt that takes it over 100 percent of GDP is held by foreign countries.]

The American Action Forum (AAF), a center-right policy institute, comes up with slightly different numbers. They estimated that

Secretary Clinton’s proposals would, on net and over a ten-year period (2017-2026), increase revenues by $1.3 trillion, increase outlays by $3.5 trillion, for a combined deficit effect of nearly $2.2 trillion over the next decade.

To illustrate these estimates, the AAF supplied the following plot.

Image Credit: American Action Forum

Note that federal revenues would stay roughly constant as a percent of GDP, while outlays increased. The AAF then gave a plot showing what the national debt would look like as a share of GDP, both under current law (red curve) and with the Clinton proposals.

Image Credit: American Action Forum.

The AAF estimates that Clinton would increase the national debt to 93.4 percent of GDP by 2026, which is well above the current law projection of 85.6 percent of GDP. This agrees with the CRFB estimates.

Concerning the increased taxes Clinton is proposing, the independent Tax Foundation makes the following points:

- Hillary Clinton would enact a number of tax policies that would raise taxes on individual and business income.

- Hillary Clinton’s plan would raise tax revenue by $498 billion over the next decade on a static basis. However, the plan would end up collecting $191 billion over the next decade when accounting for decreased economic output in the long run.

- A majority of the revenue raised by Clinton’s plan would come from a cap on itemized deductions, the Buffett Rule, and a 4 percent surtax on taxpayers with incomes over $5 million.

- Clinton’s proposals to alter the long-term capital gains rate schedule would actually reduce revenue on both a static and dynamic basis due to increased incentives to delay capital gains realizations.

The right of center organization Americans for Tax Reform (ATR), headed by Grover Norquist, notes that Hillary is proposing a net increase in annual taxes of about $1 trillion, or about 6 percent of current GDP. The ATR then makes the following points:

- First, Clinton has proposed an increase of $350 billion in income taxes, which would come from a new 28 percent cap on itemized deductions.

- In addition, Clinton would increase taxes on business by $275 billion by some undefined business tax reforms.

- Thirdly, Clinton has called for a “fairness” tax increase of between $400 and $500 billion through a number of proposals. This includes a 4 percent surcharge on the incomes of taxpayers with income of more than $5 million per year. Clinton’s website claims this would affect only 2 out of every 10,000 taxpayers, although it would really affect every American through indirect effects on economic growth that will be discussed later. Other parts of the “fairness” tax increase are taxes on capital gains and an increase in the Death Tax.

However there are other tax increase proposals for which a dollar value is not readily available. These include:

- A capital gains tax increase that ATR calls “byzantine” with six tax rates. Clinton’s campaign can not put a dollar amount on this tax increase.

- A tax on stock trading that will hit every American family with 401(k)s, IRAs and other savings accounts. This particular tax increase would be especially insidious, discouraging investing and savings for retirement.

- An “exit tax” for discouraging corporate inversions of U.S. corporations. Corporate inversions are a method for U.S. companies to escape U.S. government taxes and economic regulations. In a typical corporate inversion a U.S. company buys some foreign company and takes up its identity in the foreign country, thereby ceasing to be a U.S. company subject to U.S. economic regulations and taxes, except for profits earned within the U.S. and for the company’s operations within the U.S. In particular, an inverted company would no longer be subject to the U.S. world-wide tax regime, where the company is taxed on profits earned overseas as well as those earned domestically. Sadly, Clinton’s approach to punish a company leaving the United States with an exit tax does not address the underlying problem causing the inverting company to flee: their high American taxes. The U.S. has the highest corporate taxes in the world, except for Chad and the United Arab Emirates, with tax rates of around 39 percent when state corporate taxes are added to the federal taxes.

Unfortunately, Clinton tells us that she would continue Obama’s ways of ruling by edict, i.e. executive orders, if she does not get what she wants from Congress. On December 9, 2015, she said she would use the regulatory power of the Department of the Treasury to stop corporate inversions, if Congress did nothing to stop it. When she said this, she almost certainly did not mean Congress halting inversions by eliminating their root cause: high corporate taxes and a world-wide tax regime. If Congress passed a bill doing that, Clinton would almost certainly veto it.

In addition, she has attacked Republicans for seeking to rollback so many of Obama’s policies and regulations, and one of the regulatory laws she would defend is the Dodd-Frank Act, enacted by a Democratic Congress in response to the financial crisis of 2007-2008. She also says she understands that the misnamed Affordable Care Act, aka Obamacare, is “crushing” people financially; but instead of repealing it, she promises to fix its problems, mostly with bigger federal subsidies. Given the federal government’s humongous financial problems, this would seem to be a very problematic solution.

Given these changes in a Hillary Clinton presidency, how would they affect the American economy?

Taxes, Economic Regulations, and Corporations

First, let us look at the changes that would be generated by Clinton’s proposed tax increases. When Clinton says the government should grab more economic assets through taxation, she is saying the government knows better than the people and U.S. companies on how that capital should be allocated. From an economics point of view, the problem of increased federal spending comes from the government allocating increasingly more of U.S. capital assets, and not Adam Smith’s Invisible Hand. Yet, governments all over the world, including here in the United States, have shown themselves to be terrible investors (see here and here and here and here and here and here). Every now and then, government gets lucky, but more often than not, it simply dissipates economic assets on welfare programs that do not take people out of poverty. Nowadays, with two-thirds of government expenditures on mandatory entitlement spending, much of that spending is not even for present-day investments, but instead is required to make up for past government conversion of social security into a Ponzi scheme.

By taking more assets from corporations and the really rich, Clinton would not only be dissipating scarce resources, she would be denying them for private sector investments that would actually produce more wealth. Right now, because of high taxes and rapidly growing economic regulations, companies are finding it hard to find profitable investments and are conducting an “Atlas Shrugged” kind of strike by not investing much. Instead of investing in new productive capacity, most corporations are using their undistributed profits, along with money borrowed at close to zero real interest rates, to buy back their own common stock.

If Hillary truly wanted to improve the economy, to produce more wealth, and to provide better, higher-paying jobs, why would she want to increase the corporate tax burden even more? Already, outside of Chad and the United Arab Emirates, the U.S. has the highest corporate tax rates in the world, with a top marginal corporate tax rate of 39 percent when state taxes are included. The world-wide average is around 22 percent.

In addition, almost every developed country in the world, including all those in Europe, has what is know as a territorial tax regime, where the country taxes only those profits earned within its own borders and does not touch the profits of a company earned in foreign countries. The United States on the other hand has a world-wide tax regime where the foreign profits of an American multinational corporation are taxed twice: once by the foreign government and once by the U.S. government when the profits are brought back into the U.S. It was estimated in 2015 that 358 U.S. multinationals were keeping about $2.1 trillion of overseas profits parked in foreign bank accounts to avoid repatriating those profits to the U.S. to be double-taxed. Both the world-wide tax regime and the extremely high U.S. tax rates make U.S. multinationals uncompetitive with foreign firms over-seas, as well as here domestically in the United States!

To say we need to tax U.S. companies even more, Clinton would have to wish to drive our companies out of existence. If Clinton were instead to tax at around 20 percent and to adopt a territorial tax regime, she would make our companies instantly world-competitive. The adoption of a territorial regime would also clear the way for much of the $2.1 trillion foreign profits to be brought back to the U.S. for investment here.

Increasing corporate taxes is only one way in which Clinton would discourage investment. By increasing individual income taxes on the really, really rich, Clinton would also suppress investment from the much maligned “1%” through their individual income taxes. Most of the income and wealth of the most wealthy households is not personally consumed, but instead is invested in one way or another back into the economy. Therefore, if Hillary were to raise their individual taxes, the most wealthy could simply reduce their investments and maintain their personal consumption and life-style undiminished. If she were to raise their individual income taxes by 10%, one would expect total U.S. investments to be reduced by a similar amount. How can this cause our economy to grow? The obvious answer is that rather than growing the economy, increased taxes would thwart it.

Yet taxes are only one-half of what is keeping our economy from growing faster. The other half of the economic harm comes from U.S. government regulations. Here are my bullet-points on federal regulations:

- The costs of Federal regulations to American consumers and businesses in lost economic productivity and higher prices is estimated to be $1.885 trillion in the last year- about 10% of the nation’s annual GDP. If you think that you do not pay this cost, think again. Businesses must pass all costs on to the consumer if they are to remain solvent. You might object that the companies could absorb a portion of these costs and just take a smaller profit. If they were to do this, you and all your fellow citizens would suffer opportunity costs. The companies would have less money to invest to increase the size of the economic pie we would like to enjoy.

- If we would divide the national regulatory costs among all the nation’s families, each household would have to pay an average of $15,000. Since the average family budget is $51,100, this per household cost would amount to about 29% of the average family’s expenditures.

- This statistic is truly stunning! The regulatory compliance costs to businesses exceed the $182 billion revenue the IRS is expected to collect from both individual’s and companies’ income tax in 2015. No wonder companies are having problems making a profit!

These points were gleaned from an annual report put out by the Competitive Enterprise Institute, entitled Ten Thousand Commandments.

Some regulations are indeed required to avoid Garret Hardin’s Tragedy of the Commons: regulations insuring clean air and clean water are of this nature. However, other regulations were written on false premises, such as the regulations from the Dodd-Frank Act. Those regulations on the financial industry were written on the mistaken premise that the 2007-2008 financial crisis was created by the private sector financial industry, rather than by the federal government, which was the actual case. Then there are regulations, such as come from the Affordable Care Act, where some politicians try to dictate our behavior and how we spend our own money.

These are the regulations Clinton is pledged to either continue or to tweak to fix them. As with any progressive politician, the modern administrative state is much to her liking.

Federal Spending and Catastrophe!

Some of Hillary Clinton’s plans for this country, particularly those involving taxes and spending levels, are so foolish, I find it very hard to understand just why she would propose them. Putting even more taxes on corporations and high income individuals can only cause even less GDP growth and the loss of jobs.

More than that, she is focussed on increasing government expenditures, when the very financial survival of the government is dependent on decreasing expenditures. Increased growth of the economy would help, but would be insufficient for what is needed. In fact we need to cut the largest and fastest growing part of the federal budget: mandatory entitlement spending, which means the spending on Social Security, Medicare, and Medicaid. These programs comprise about two-thirds of all federal expenditures. Defense expenditures are only 16 percent of the budget, with other discretionary spending being another 16 percent. I demonstrated in the post The U.S. Federal Government Budget that without such cuts, the U.S. government will spend itself into virtual nonexistence. In roughly a decade’s time (two at the outside), expenditures on the entitlements plus interest on the national debt will absorb every single penny of federal revenues. There will nothing left to spend on other government functions, like defense. We can not tax our way out of the problem because of Hauser’s Law. We can not simply move assets from the discretionary part of the budget, which includes the defense budget, because that piece is much too small.

These are hard facts, of which Hillary Clinton remains blissfully ignorant.

Views: 1,740