Progressive Mendacity on Tax Reform

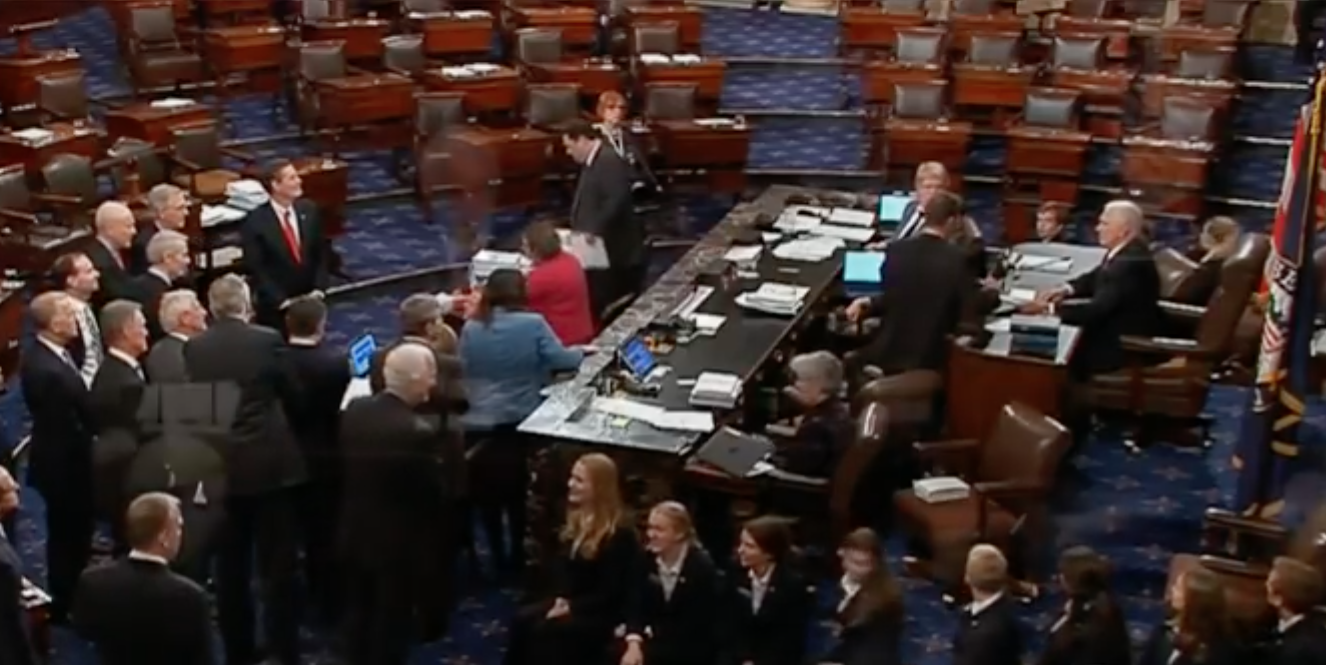

Vice President Mike Pence, as President of the Senate, announces final passage of the Tax Cut and Jobs Act in the Senate, 51-48.

Screen shot of Right Side Broadcasting Network video on Youtube

The lies of progressive politicians, pundits, and progressive allied news media have seriously misled Americans about what the recently passed GOP tax reform bill actually does. Senate minority leader Sen. Chuck Schumer (D-NY) may have claimed Republicans “will rue the day” they passed the tax bill, but it is far more likely Democrats and their supporting news media echo chamber will rue the day they misrepresented and opposed tax reform. This might happen as soon as next February when American workers discover their new, lower payroll taxes.

What the Tax Reform Bill Actually Accomplishes

Admittedly, most of the improvement in taxes comes on the corporate side of the new tax code, where tax cuts and reforms are much greater than on the individual side. Even so, individuals should experience a definite improvement in their lives because of increased economic activity producing more jobs and increasing wages and salaries. Yet as I noted in the post Do U.S. Companies Need Tax Cuts?, American corporations have labored with a severe competitive disadvantage with foreign companies just because of taxes. At a U.S. corporate tax rate of 39% (35% federal plus an average 4% state tax rate), the United States has the highest corporate tax rates in the world.

Progressives have responded to this observation by claiming once companies take full advantage of all tax breaks available to them, they hardly pay any tax at all. However, if you do the math yourself, you find that it just ain’t so! Suppose you take the S & P 500 companies in 2016 as representative of the larger U.S. corporations. If you then take the tax paid by each company, divide that by their earnings before taxes, and multiply that by 100%, you get their effective tax rates taking into account every tax advantage they took. When I went through the exercise, I obtained the companies’ financial data from Morningstar.com. Among the 500 companies, a total of 46 — or 9.2 percent — reported losses for 2016. You know you are living in economic hard times when almost one-tenth of your largest companies can not make a profit! Of the remaining 454 companies, 313 or 68.9% had effective tax rates above the European average of 18.88%, This left American companies at a huge competitive disadvantage with their European competition, and indeed with much of the rest of the world. The new tax code reduces the federal tax rate to 21%, or a total tax rate of 25% when you add the 4% average state rate. This still leaves our companies at a disadvantage, albeit greatly reduced.

Equally important for U.S. international competitiveness is the conversion of the corporate tax system from a world-wide system to a territorial one. Under the previous tax regime, companies that sold and produced wealth overseas were taxed twice on their overseas earnings: Once by the government of the country where the income was earned, and a second time by the U.S. when the earnings were repatriated to the United States. As a result, U.S. multinational corporations have every motivation to invest their overseas profits overseas, or to park them in foreign banks to avoid U.S. taxes. This is especially true since the overseas profits would qualify for few (if any) of the U.S. targeted tax breaks. It has been estimated that U.S. corporations have stashed around $2.5 trillion in cash in foreign bank accounts, an amount equal to 13.3% of the current $18.8 trillion GDP. Needless to say, if that money could be enticed back into the United States and invested here, it would go a long way to create new jobs and help the U.S. to adjust to the effects of foreign trade.

Almost all countries in the Organization for Economic Cooperation and Development (OECD) have territorial tax systems of one form or another, and the U.S. is one of the very few that taxes its companies on foreign income. Of the 34 OECD nations, 28 have some form of territorial system, and almost all our European competitors have territorial systems. Being double taxed on foreign income, especially at high tax rates, while our biggest foreign competitors were not, is a further reason American companies were hobbled in foreign trade. It is no wonder so many formerly American companies have fled the U.S. for new foreign homes, and that so many American jobs have been outsourced to other countries! The new tax code will correct this glaring problem.

Although the improvement in corporate taxes is the greatest, improvements in the tax structure for individuals and households are not negligible. Below are displayed both the old and new individual and household tax brackets. Since there are tax brackets under the old and new tax codes with different tax rates, tax rates under one code or the other that do not exist are labeled as “Not applicable.” Your taxable income that dictates your tax rate is determined by deducting any applicable deductions. The standard deductions have been approximately doubled from the old code, from $6,500 to $12,000 for single filers, and from $13,000 to $24,000 for a married couple filing jointly. The child tax credit that people can subtract directly from their taxes also doubles. Under the old code it starts at $1,000 and begins to phase out as income increases beyond $110,000 for couples and an income of $75,000 for everyone else. With the new tax law, the credit increases to $2,000, and does not start to phase out until an income of $400,000 for couples and $200,000 for singles.

| Tax Rate | Current 2017 Taxable Income Bracket | New 2018 Taxable Income Bracket |

|---|---|---|

| 10% | Less than $9,325 | Less than $9,525 |

| 12% | Not applicable | $9,525-$38,700 |

| 15% | $9,326-$37,950 | Not applicable |

| 22% | Not applicable | $38,701-$82,500 |

| 24% | Not applicable | $82,501-$157,000 |

| 25% | $37,951-$91,900 | Not applicable |

| 28% | $91,901-$191,650 | Not applicable |

| 32% | Not applicable | $157,501-$200,000 |

| 33% | $191,651-$416,700 | Not applicable |

| 35% | $416,701-$418,400 | $200,001-$500,000 |

| 37% | Not applicable | Greater than $500,000 |

| 39.6% | Greater than $418,400 | Not applicable |

| Tax Rate | Current 2017 Taxable Income Bracket | New 2018 Taxable Income Bracket |

|---|---|---|

| 10% | Less than $18,651 | Less than $19,050 |

| 12% | Not applicable | $19,051-$77,400 |

| 15% | $18,651-$75,900 | Not applicable |

| 22% | Not applicable | $77,401-$165,000 |

| 24% | Not applicable | $165,001-$315,000 |

| 25% | $75,901-$153,000 | Not applicable |

| 28% | $153,101-$233,350 | Not applicable |

| 32% | Not applicable | $315,001-$400,000 |

| 33% | $233,351-$416,700 | Not applicable |

| 35% | $416,701-$470,700 | $400,001-$600,000 |

| 37% | Not applicable | Greater than $600,000 |

| 39.6% | Greater than $470,700 | Not applicable |

Perusing the tables you can see definite gains for individuals and households. For example, suppose you are married filing jointly and your taxable income after subtracting your standard deduction of $24,000 is between $19,051 and $77,400. That means your actual income is between $43,051 and $101,400, putting you squarely in the middle of the middle class. You will now be taxed at a rate of 12%, whereas under the old tax code you would be taxed at a rate of either 15% or 25%, depending on where you fall in the bracket. Your gains might not be as dramatic as for corporations, but they are not too shabby either. You can console yourself with the greater gains of companies by noting that you might not have a job, or your wage or salary might not be as high if companies could not compete with foreign competition, or if they did not invest as much in increasing their own productive capacity.

One controversy greatly emphasized by the news media was the possible elimination of State and Local Tax deductions (SALT). These federal income tax deductions adjust the federal tax according to the amount of state and local income and property taxes paid. For the very high tax states run by progressives, these deductions might even be necessary for their financial survival. Initially, draft versions of the tax bill would have completely repealed SALT deductions, but some Republicans from the high tax states (New York, New Jersey, California, and Illinois prominent among them) threatened to stop the bill unless those provisions were removed. The final solution was to cap SALT deductions at $10,000. This along with the doubled standard deductions will probably protect the middle class in high tax states. However, given the very high progressiveness of taxes in those states, the richest in those states will probably be hurt to some degree. In fact the biggest fear of the progressives who control the blue states might well be the SALT caps will motivate a large fraction of their richest citizens to flee their states. That would leave the high tax states in an even more desperate financial condition. Related provisions are a reduction of the mortgage deduction’s principal limit for new mortgages from $1 million to $750,000; and an increase for the cash contributions deduction limit for donations to qualifying charities from 50% to 60% of adjusted gross income. Clearly, the bill favors private charities over state and local governments.

A final report on the tax reform by the left-of-center Tax Policy Center dated December 18, 2017 states,

Urban Institute & Brookings Institution Tax Policy Center

While the tax cuts for the 95th percentile and higher are two to three percent higher than for the middle class according to this analysis, nevertheless if the goal is to stimulate the economy, that is precisely where you would want the largest cuts. If what is desired is to have the private economy allocate more economic resources and the government less, you have to cut taxes most for those who pay the most taxes. In 2014 the top 10% in income had a 47.2% share of the national income, but paid 70.9% of the income tax revenue. The bottom 90% in income (all us poor folk) had a 52.8% share of national income and paid 29.1% of all income taxes.

Below is a video published by the Right Side Broadcasting Network on Youtube of the White House victory celebration of the bill’s final passage. If you watch this video, pay particular attention to the penultimate speaker, Rep. Kevin Brady (R-TX), Chairman of the House Ways and Means Committee. He tells us there are three dates everyone should put on their calendars. The first is New Year’s Day, when the old tax code expires and we begin to be taxed under the new tax code. The second date is the first of February, when every payday American workers should start to notice larger paychecks because of the reduction of payroll taxes. The final important date is tax day, April 15th. That will be the last day companies, individuals, and households will have to file income tax returns based on the old “horrible, broken” tax code.

Already, even before it has become effective, the new tax code has generated promises of additional corporate investment and higher wages for employees. As President Trump noted at the beginning of the video above, AT&T has announced that because of the tax plan they will increase domestic investment by $1 billion and pay a $1,000 bonus to most of their American employees, including all union, non-management, and some line management employees. At virtually the same time the Boeing Corporation said it would invest $300 million in employee training, improved workplace infrastructure and corporate giving. In its reaction to the passage of the tax bill, Fifth Third Bancorp said it would raise its minimum hourly wage to $15 per hour and pledged $400 million for community and nonprofit organizations. Comcast Corporation said it would give $1,000 bonuses to around 100,000 employees, and planned to spend more than $50 billion in infrastructure investments over the next five years. Wells Fargo will also up its minimum wage to $15 per hour, and allocate $400 million in 2018 to community and other nonprofit organizations. And all of these announcements of additional investments, wage and salary increases, and charitable giving have been made only a couple of days after the final passage of the bill! How much more will other companies decide to invest in the United States in the next few months?

Progressives have consistently claimed over the past year that corporations would never invest much of any tax cuts they received, but instead would follow their usual practice during the Obama years of using free cash to buy back their stock. However, what they do not seem to recognize is that there were very rational reasons for companies not to invest in the U.S. during those barren years. Accumulated government regulations and taxes had greatly reduced the possibilities for earning profits domestically. This is also part of the motivation that drove so many U.S. corporations overseas to become foreign companies through corporate inversion. It is also the reason so many jobs were outsourced overseas. Capital is like a fluid that flows away from where it is penalized toward where it is appreciated. Now that Trump and the GOP are reducing huge regulatory costs and taxes, companies are calculating it is again profitable to invest in the United States.

Progressive Misrepresentations

A slew of recent public opinion polls show a majority of Americans believe the new GOP Tax Cut and Jobs Act will not cut their taxes but will only help the very wealthy. One representative poll is the Wall Street Journal / NBC poll taken over the period December 13 to 15. The results, which are billed as having a statistical error of ±3.3%, are displayed in a bar chart below.

Wall Street Journal / NBC News

When asked about the new tax law, 17% of the respondents said their family would pay less taxes, and 32% said they would pay more. The results also showed 41% of Americans in the survey believed the tax bill was a bad idea, an increase from 35% in October. Less than 25% believed the bill was a good idea. From the bar chart above you can see that for three of the questions, around 25% did not think they had enough information to form an opinion, with 20% thinking so on the question about corporations. Other recent polls, such as the Monmouth University poll and the Quinnipiac University poll have given similar results. The clear picture from these polls is that the majority of Americans believe they will not gain much from the tax reform, while the rich and corporations will benefit a great deal at the expense of most Americans. Their belief that American companies will greatly benefit is certainly accurate, as we have already seen from the provisions of the act; but why would they believe they and their families would not get any tax cuts? Why would they believe cutting taxes for businesses would be a bad thing? From everything discussed above, those conclusions are just plain false.

What this response to the tax reform by most Americans demonstrates is both the power of the progressive news media, as well as its mendacity. Most of what ordinary Americans learn about tax reform or any other aspect of Trump’s and the GOP’s policies, they learn from the progressive allied news media. This particular segment of the news media has been hostile toward the GOP for a very long time, at least since the times of the Vietnam War and increasingly so since the George W. Bush administration and since Barack Obama was elected president. With the election of Donald Trump and the continuing GOP majorities in Congress, they (CNN, ABC, CBS, NBC, MSNBC, the New York Times, the Washington Post, the Los Angeles Times, etc, etc.) went absolutely crazy. In the words of Victor David Hanson,

The media is not disinterested. Networks such as CNN see their role actively on the barricades, devoted to the higher cause of destroying the Trump presidency, not as reporting its successes or failures. The danger to free expression and a free media is not even Trumpian bombast. It is the far more deliberate and insidious transformation (begun in full under Obama) of journalism into a progressive ministry of truth. Even if he wished, Trump could not take away what the professional press already surrendered voluntarily.

With the progressive media hammering the public day in and day out about how evil everything the Republicans, Trump, and neoliberals in general thought and did was, it is no wonder a large part of the public might be persuaded.

However, now that Trump has successfully begun the deconstruction of the regulatory state and now that tax reform act has successfully been signed into law, what progressives and their allied media should really fear is that these measures will be immensely successful, both economically and socially. This is especially true because of the extreme intemperance and unequivocal certainty in their condemnations of these policies. Even before the passing of the Tax Cuts and Jobs Act, companies have been increasing their investments with new orders of capital goods and new orders of durable goods. GDP has been growing in excess of 3% for the past two quarters. Personal income has finally begun to increase again. Retail sales are increasing. M2 money velocity is once again increasing in a noninflationary environment. All of these hopeful signs have been generated just on the strength of Trump’s deregulatory executive orders and the promise of future tax cuts and reforms. Now that tax cuts and reform are actually here, we can expect economic growth to explode and real individual incomes to rise —assuming that we are living in the neoliberal universe and not the alternative progressive universe. As mentioned earlier, ordinary people will get some of the first indications progressives have been lying to them when they see their smaller payroll taxes in February. The next indications will come — again assuming the neoliberal view of reality is true and the progressive view false — with continued increases in the GDP growth rate, jobs, and personal income.

Views: 3,352