How Big A Problem Is Inflation For Stock Markets?

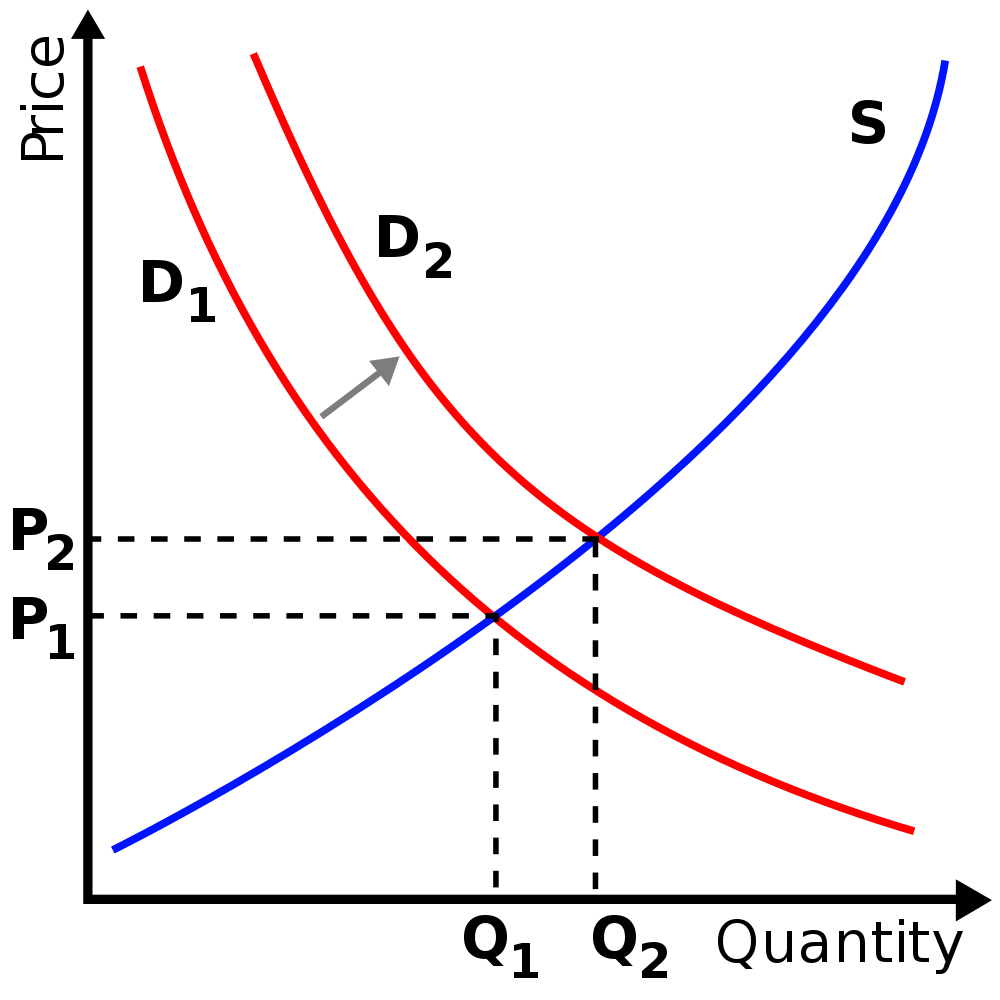

Inflation caused by increases in economic demand predicted by the law of Supply and Demand.

Wikimedia Commons / SilverStar at English Wikipedia

One often mentioned explanation for plunging stock markets has been the specter of inflation raising its ugly, grisly head. With the American economy rousing from its slumbers, many expect rising demand for goods and services to motivate the Federal Reserve to raise interest rates.

There are other reasons for the recent stock market decline. The one I find most compelling is the fact stocks have not undergone a correction for a very long time; it is past time for investors to unload their over-priced stocks with high price-to-earnings ratios, and to rebalance their portfolios. Nevertheless, the fears of future inflation and consequent increases in interest rates are hardly trivial. Moreover, inflation is a possibility with much wider importance and concern than just for the stock market. How much should we and the markets fear it? Let us take a look at the phenomenon.

The Nature of Inflation

Inflation is a monetary process in which your money loses its buying power. As inflation proceeds and prices for goods and services generally increase, you will need more money to buy the same goods and services. In the opposite process of deflation, prices generally decrease, and can be considered a negative inflation. What are the factors determining the inflation or deflation rate?

There are three such factors: the total number of dollars in the money supply, M; the value of the year’s Gross Domestic Product (GDP), T; and the velocity of money, V, which is defined as the average number of times a dollar changes hands in transactions during the year. Now, if you take the total number of dollars in the money supply and multiply it by the average number of times each is exchanged in transactions in a year, you will get the total dollar value of all transactions that year. That by definition is the GDP. Then we have

The dollar values in this equation are all in the current dollars of that year. To discuss changes in price levels between years, we must introduce a price index P that relates the dollars in the current year to those in some base year, whose dollars we will call constant dollars. Let us say that in terms of constant dollars, the GDP for the current year is represented by the lower case t. Then,

We will now suppose that in the following year each of these quantities are changed by some amount. For example, the price index connecting the following year’s dollars to constant dollars is given by

You can regard the Δ symbol as an operator giving the difference between any year’s quantity and the previous year’s. Our equation for the following year’s GDP then becomes

Expanding the multiplications and recognizing Pt on the left side equals MV on the right side, we get

Next, we divide the left hand side of this equation by Pt, and the right hand side by its equivalent MV. The result is

Finally, we will assume all the changes in quantities are very small compared to their previous year’s values. Neglecting changes quadratic in the fractional changes, we obtain

Rearranging terms, we finally get an equation for the change in the price level between the two years.

Let’s call this equation the inflation equation. The fraction ΔP/P , multiplied by 100%, gives us the inflation rate between the two years if it is positive; and the deflation rate if it is negative. Clearly, the inflation rate will increase with positive increases in the money velocity and the quantity of money, and decreases with growth in the GDP. A PDF giving a slightly different derivation of this inflation equation using differential calculus, along with a description of how a price index P can be constructed can be found here.

Notice how this equation can be consistent with the picture of demand-driven inflation illustrated in the plot at the top of this post. Any point along the supply curve S gives the the price at which the average producer or seller would be willing to produce or sell a given quantity of goods. Any point along a demand curve gives the price at which the average consumer would be willing to buy a given quantity of goods. The point where the two curves intersect makes the price and quantity of a good at which producers are willing to produce and consumers are willing to buy the same. At this market equilibrium point everything produced will be sold. If nothing (like government and its regulations) forces prices away from the market equilibrium, market forces themselves will cause prices and quantities to converge on this equilibrium.

If for some reason there is an increase in economic demand for a good, that means consumers — including companies buying raw materials and intermediate goods — are willing to pay increased prices to get more of this good. This change in consumers’ valuation of the good causes its demand curve to shift from D1 to D2, as shown above. The prices then increase from P1 to P2 and the quantities bought rise from Q1 to Q2. If demand curve shifts like this happen for most goods and services, a general rise in prices, also known as inflation, will be generated.

This might occur because government does things like cut taxes for both companies and individuals. The government might also decrease costly and onerous economic regulations on companies. Companies might then see an opportunity to earn more by producing and selling more with fewer costs and with less tax on their profits. Seeing such opportunities, companies might then hire more labor, raise wages to keep scarce skilled labor from leaving for competitors, and invest in more production. Increasing numbers of workers with higher wages, together with their corporate employers, would then increase economic demand for all sorts of goods and services. This sort of sounds like the situation we find ourselves in the United States today!

One other point needs to be made about demand-driven inflation. Although the prices rise, so do the quantities of goods produced and sold. If economic production generally increases, then so does the GDP t. If the term Δt/t in the inflation equation increases, it subtracts from the inflation rate. The only way this can happen and still have positive inflation is if the sum of the percent changes in the quantity and velocity of money are larger than the percent increase of the GDP. If there is increased production, the system will need more money to meet all needs, or the existing money will have to do double duty (or more), or there will be deflation as the sum of all three terms in the inflation equation becomes negative.

Why Inflation (and Deflation) Is Bad

Well, of course, inflation is bad! By destroying the value represented by the money you possess, it reduces your claims on wealth. Of course, it also helps demolish whatever debt you hold, which is bad for the economy since it subtracts from the wealth of whatever bank or company holds your debt. Yet, these considerations only scratch the surface of why inflation, or its inverse deflation, is destructive to an economy.

Consider first the roles money must play in any economy. Then, we will think of the destructive consequences of what happens when its value varies in time.

- Money is a medium of exchange: As most everyone knows, money in and of itself is not wealth. Instead, it is a claim check for wealth. When you are paid for something productive you do, you are given these claim checks. You can redeem them for real wealth every time you buy something. This allows people who produce different things in the economy to procure what they do not produce themselves without bartering. Because they can do this, they can specialize in their economic activity. This allows for the division of labor that is a major source of productivity.

- Money is a store of value: Possessing money, an individual can retain the value of his income without having to immediately consume it. This allows investment, or savings that is redirected by banks to investment.

- Money is a unit of Account: That is, it is a common measure for assessing the relative worth of goods and services. This statement can be recast in the following form: Money is a conduit for signals to producers and consumers alike of what should be produced and bought. Those signals telling how much consumers are willing to pay and producers willing to accept for their products are in units of money. Without money having a relatively constant value, these signals become garbled and lead to mistakes in allocating scarce resources.

Either inflation or deflation can seriously damage all three of money’s major roles. In a system with moderate inflation, the biggest damage is to the last two roles. However, in a system with hyperinflation, money as a medium of exchange ceases to exist.

If inflation is moderate but growing, the people who are primarily hurt are the creditors who hold other people’s debt. Debt is measured in units of money, and if those units lose their worth through inflation, the creditor gets a much lower real return than he expected once the debt is repaid. Also, employers generally will have to increase wages and salaries to keep up with inflation if they expect to retain their workforce. Then, the debtor would have to work fewer hours to pay back his or her debt. However, although moderate inflation is the debtor’s friend, it is the creditor’s bane requiring banks and credit card companies to increase their interest rates to compensate. Such an environment would tend to discourage individuals and companies from taking out loans for any kind of investment.

If the inflation rate is negative, i.e. a deflationary environment, creditors would be favored and debtors penalized by having to pay back dollars more valuable than the ones they borrowed. On the other hand, interest rates would be greatly reduced and loans would be readily available, assuming already indebted companies and individuals would even be interested.

To have either inflation or deflation is ultimately destructive to the economy. If people and companies are to be motivated to invest and save for the future, they must be assured that money is a safe store of value, and that the signals prices send about the worth of goods are accurate. For the monetary policy of the central bank, the Federal Reserve in the United States, to be other than to aim for absolutely zero inflation is to dice with the Devil.

How the Federal Reserve Can Control Interest Rates and Inflation

The Fed could restrain inflation by various mechanisms. It could increase reserve requirements, called the reserve ratio, for its member commercial banks, thereby decreasing the money supply in circulation. If the reserve ratio is decreased, member banks can lend more to their customers, increasing the money supply.

It could increase the interest rate the Fed charges member banks for borrowing from the reserves the Fed holds. This interest rate is called the discount rate, or the Federal Funds Rate or Fed Funds Rate. Commercial banks would then pass on these interest costs to their customers when making loans.

Finally, the Fed could adjust the quantity of money available to the economy through “open-market operations.” Open-market operations are transactions of the Fed with member banks where the Fed requires member commercial banks to either buy or sell government securities. When the Fed sells securities to private banks, it takes the money paid for the securities out of circulation, effectively destroying that money. When the Fed buys, it pays the banks for the securities, thereby putting more money, effectively creating it, into the circulating money supply.

Clearly, the Federal Reserve has a very flexible set of tools for controlling and managing the money supply. However this says nothing about how the Fed should use them. The governors of the Federal Reserve Board, the highest ranking officers of this independent government agency, have always insisted they should be given absolute discretion in the setting of monetary policy. Being mostly Keynesian economists in the past, they saw Fed monetary policy as a tool they could use to stimulate the economy as needed. In 2003 the Chairman of the Board of Governors, Ben Bernanke, gave a speech before an academic audience at New York University. In it he discussed the advisability of using a strict, relatively simple monetary rule for setting policy, versus the established tradition of giving the Board’s governors maximal discretion. He declared,

On the other side of the debate, advocates of discretion have firmly rejected the use of strict rules for policy, arguing that central bankers must be left free to set monetary policy as they see fit, based on their best judgment and the use of all relevant information. Supporters of discretion contend that policy rules of the type advocated by Friedman are simply too mechanical and inflexible for use in real world policymaking; in particular, simple rules cannot fully accommodate special circumstances or unanticipated events.

In the past (I have in mind the 1970s and the 2007-2008 crisis), the Fed has tried to stimulate the economy, only to generate inflation or stagflation, or to inflate asset bubbles. In addition, Federal Reserve discretion caused the Great Depression of the 1930s when they used a “real bills” doctrine to reduce the U.S. money supply by about one-third. In more recent times, Keynesians on the Federal Reserve have used a spurious concept called the Phillips curve, which envisioned a trade-off between the unemployment rate and inflation. Yet, as discussed above, any inflation (or deflation) whatsoever damages every role money must fulfill to keep the economy healthy.

Because Federal Reserve Board discretion has worked so poorly in the past, and because the entire purpose of monetary policy should be to enable all three of money’s economic roles, the application of an inflation targeting rule with zero inflation as the target would appear to be optimal. Benefits should include reduced inflation volatility, reduced inflationary impact of shocks, and the setting of a constant expectation of a given inflation rate in society. In reaction, Keynesians would object such a policy would have the following drawbacks:

- Restricted ability of the central bank to respond to crises or unforeseen events;

- A policy that would not be explicitly responsive to unemployment, undesirable exchange rates, and other macroeconomic variables besides inflation;

- Potential instability in the event of large supply-side shocks.

However, a neoclassical economist would say these kinds of problems should not be addressed by monetary policy anyway, but typically by tax cuts, reduction of economic regulations, and/or other national responses to international trade problems. These are the provinces of the political branches of government, the Congress and the executive.

Whether or not society, including the stock market, should be extraordinarily worried about inflation depends very much on how the Federal Reserve attacks the problem.

How Much Should Stock Markets Worry About Inflation and Interest Rates?

The possibility of inflation, positive or negative (deflation), is never a trivial concern. If the Federal Reserve would adopt an inflation targeting rule aiming at zero inflation, the concern should be limited to how successful the Fed would be in implementing it. However, if the Fed uses its discretion, or uses some other monetary rule that attempts to stimulate the economy, everyone should be exceptionally worried about an unintended acceleration of inflation, or even worse of a return to 1970s style stagflation.

One way to assess how important inflation might be in the near future would be to use the inflation equation we have derived with our best estimates for the three terms on the right hand side of the equation. Below is a graph of M2 money velocity from the year 2000 to the beginning of 2018.

St. Louis Federal Reserve Bank / FRED

In the fourth quarter of 2017, the annual change in money velocity was about -0.35%, and it appears to be increasing about 2% per year. Therefore, let us guesstimate that by Q4 2018 ΔV/V will be above 1.65%. Since the economy should accelerate even further because of the recent passage of the Tax Cuts and Jobs Act, let us err on the side of an inflationary environment and round upwards to ΔV/V=2.0%.

The Federal Reserve data on M2 money supply is given in the graph below.

St. Louis Federal Reserve District Bank / FRED

The percent change from a year ago decreased from 6.57% in January 2017 to 4.72% in December 2017. If we assume the Federal Reserve, anticipating an overheating economy, causes a similar reduction in 2018, we get an estimate at the end of 2018 of ΔM/M=2.87%.

Finally, it is almost universally expected that 2018 GDP growth will be north of 3.0% and may be as large as 4.0%. Therefore, we will estimate 3.0% < Δt/t < 4.0%

Therefore, if we do the sums, we estimate the inflation rate by the end of 2018 to be

ΔP/P = 1.87% if the GDP growth rate is 3.0%, and ΔP/P = 0.87% if the growth rate is 4.0%.

For at least the next year, it would appear the markets will have very little to worry about inflation.

Views: 2,598