Federal Budget Deficits and Spending Restraints

Budget Stops Growing! Image Credit: International Liberty

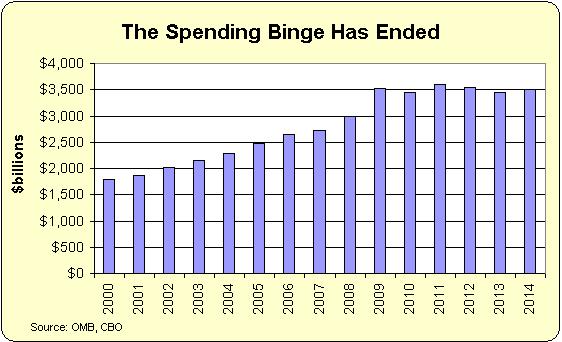

A tip of the hat to Dan Mitchell, who blogs on the website International Liberty! The motto for his website is “Restraining Government in America and Around the World“, so if by chance you have detected my biases from my posts, you can understand why I have been attracted to his website. In January he had posted on some very interesting developments on federal expenditures, namely that they have stopped growing! In support of this observation, he put the chart shown above in his post. As you can see from the chart, spending has skyrocketed from about $1.7 trillion in the year 2000 to $3.5 trillion in 2009. Then from 2010 through 2014 spending has remained relatively constant.

Not that this unexpected spending restraint can be credited to President Obama and his allies. Throughout Obama’s tenure they have been calling for more and more spending for various and sundry projects. So who or what gets the credit? First, as Mitchell points out, there are some accounting gimmicks that account for some of the flattening. There are some government revenues that are actually counted as “negative expenditures”, such as TARP repayments from Fannie Mae, Freddie Mac, and assorted banks and corporations, especially for 2009 through 2013. After 2013 there was little TARP contribution to the “negative expenditures” on the budget.

Image Credit: US Dept. of Treasury

The first big real source of spending restraint came from the seizure of the House of Representatives by the Republicans after the “tea party” election of 2010. Once the GOP held one house of Congress, especially the one in which budgets are constitutionally mandated to start, Obama and friends could not produce new, expansive budgets. Of course Harry Reid’s Democratically-held Senate could block Republican budgets from the House that would actually reduce expenditures, and if any had made its way through the Senate, it would have been vetoed by the President.

Tea Partiers and citizens of all persuasions. please take note! The featured post image above shows that Republicans in Congress had some good effect in restraining government expenditures! If you want them to do more, you can get your wish only if you elect a Republican president in 2016.

As a result of the House turnover, Republicans were able to win some spending caps from Obama in the debt-limit fight of 2011. Then came President Obama’s biggest loss of government expenditures with the sequester fight of 2013. Sequestration is a process where pre-specified automatic spending cuts are made if Congress and the President could not agree on a budget. Sequestration was authorized by the Budget Control Act of 2011, signed by Obama as a compromise with the new Republican House. The bill specified that sequestration would begin in 2013, and the cuts would be evenly split between defense and non-defense expenditures. The President apparently thought Republicans would not be able to bear Defense cuts of such large amounts, and could be pressured into expenditures he wanted in 2013 rather than to suffer the cuts. If that was his expectation, he was grievously and fortunately disappointed, as Republicans considered continued budget deficits to be even more threatening to the Republic than external military threats. Sequestration went into effect beginning January 2, 2013. Over the eight years between 2013 and 2021, it is slated to cut spending by $1.1 trillion from what would otherwise have been expected.

After the sequestration the next event of note was the government shutdown beginning October 1, 2013. By that date if there were no budget passed, the President would have to be given a “continuing resolution” by the Congress to be able to continue spending at the old allocations. The Republicans had tried up to that time to first repeal and then to defund Obamacare in the new budget. They were using the threat of not producing a continuing resolution to get their budget passed, but the Senate supported the President and stripped out the defunding sections of the legislation. With no budget and no continuing resolution, the government shutdown all but critical operations such as the Defense Department. Eventually, under political pressure the House Republicans surrendered and passed a continuing resolution on October 16, 2013.

Although Republicans were unsuccessful in defunding Obamacare, Mitchell has some interesting observations that this fight was worth having in advancing the goal of smaller government and less government spending.

Another point Mitchell makes is that, for the moment at least, just a small amount of government spending restraint can mean a whole lot in budget deficit reduction. Consider the Dan Mitchell’s chart below.

The blue curve shows estimated revenues from 2015 to 2025. The other straight lines are what expenditures would be if they are increased at a constant rate from 0% to 3%. If any expenditure line is below the blue revenue curve, the budget would be in surplus. From this chart you can see that if spending was constant (the red line for 0%), the budget would be balanced sometime in 2017. At 1% spending growth, the budget balances in 2019, and at 2% in 2021. Even at 3% spending growth, Mitchell has the budget balancing sometime in 2024. One word of caution: Because this chart has the budget balancing even with a 3% expenditure growth, the values on the blue revenue curve must assume an annual GDP growth rate that is the long term average of a little over 3%. There is no way the budget can be balanced in a sustainable way if expenditure growth is larger than GDP growth. In recent years our GDP growth has averaged around 2% per year, creating yet another worry. Nevertheless, if we only restrained the growth of government by a modest amount, the balancing of the budget is quite possible.

Now I must point out the fly in the ointment. Starting with sometime in the 2020s, the spending for the entitlements (Social Security, Medicare, and Medicaid), will begin to take so much of the GDP that it will start to crowd out all other government functions and investment in the economy. The Heritage Foundation projects entitlement spending at 34% of GDP by 2035. However, this leaves out Obamacare, which should be an expensive and growing entitlement by then if it is not repealed. The Heritage Foundation probably also assumes a GDP growth rate of our longterm average of over 3%. If we have entered an age of secular stagnation with a long term average GDP growth of 2%, the entitlement crisis will hit far, far sooner.

Views: 2,684