Economic Freedom in the United States

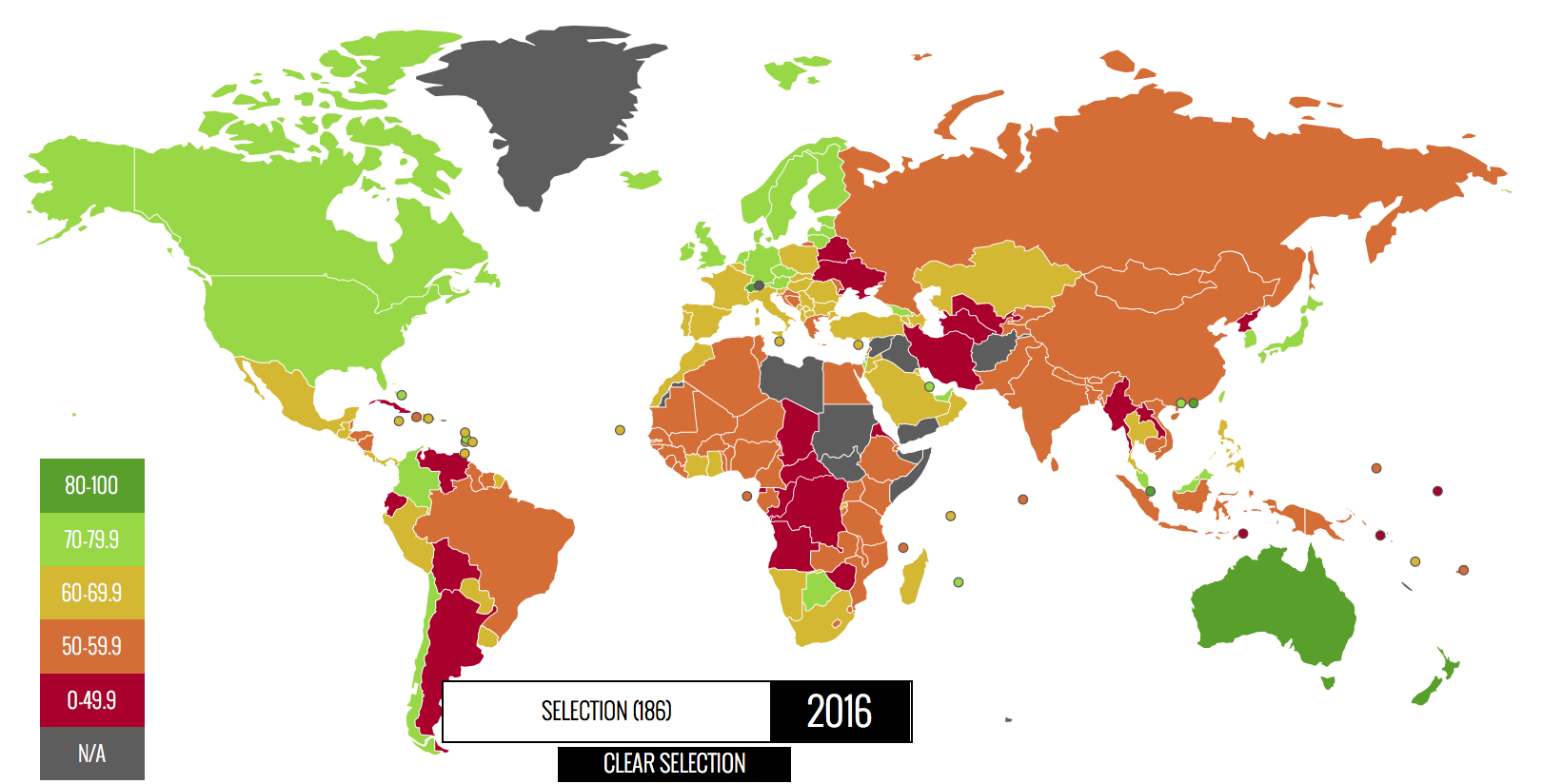

World Map of the WSJ/Heritage Foundation Index of Economic Freedom

Image Credit: Heritage Foundation

It would distress many Americans to learn the United States does not have the greatest economic freedom in the world. Indeed, in the latest 2016 rankings by the Wall Street Journal/Heritage Foundation Index of Economic Freedom, the U.S. ranks eleventh behind tenth rank United Kingdom. In fact, the U.S. is currently declining in economic freedom, having fallen 0.8 points from the previous year’s ranking.

The Index of Economic Freedom is a number calculated for each country for which enough data is available that measures the degree to which government does not repress private individuals’ economic activity. Its values range from 0 for a totalitarian, socialist country that totally controls the economy to 100 for the most conceivably free laissez-faire free-market. The eight countries not ranked due to lack of data are Afghanistan, Iraq, Libya, Liechtenstein, Somalia, the Sudan, Syria, and Yemen. With the exception of Liechtenstein, the unranked countries are all racked by the war between radical Islamic jihadis and everyone else in the world.

The Index of Economic Freedom for the U.S.

Out of a scale of 100, 100 being most economically free, the U.S. scores 75.4 in the 2016 listings. The United Kingdom just above us scores 76.4, while Denmark just below us scores 75.3. Over the last year the United Kingdom increased its score by 0.6, while the United States and Denmark both declined in score by -0.8 and -1.0, respectively. If you think about it, this means that even though the U.S. is declining in economic freedom, Denmark is falling even faster and had scored above the U.S. a year earlier, while the rising United Kingdom which had been below us last year is now above us. The world average score is 60.7, while the five countries rated with free economies (Hong Kong, Singapore, New Zealand, Switzerland, and Australia) averaged 83.9.

These time shifts suggest the question of what the U.S. index might look like graphed over a period of years. The answer is given in the plot below of the U.S. index from 1995 to 2016. As a comparison, the world average of indices is also plotted.

Data Source: WSJ/Heritage Foundation

Notice that the U.S. index from 1995 to 2008, although exhibiting some ups and downs, had a gently rising trend upwards. From 2008 to the present, American economic freedom has been steadily falling under the Obama administration. With President Obama attempting to increase government spending, and the reach of the administrative state and economic regulations, we should not be surprised by this result at all. Nevertheless, his second term efforts have been partially stymied by a Republican Congress. To find how the government is taking our economic freedom away from us, we need to look at the changes in the components of the index.

Rule of Law

The property rights score stayed constant at 80.0, while the freedom from corruption rose to 74.0. The rising of the freedom from corruption is something of a surprise with the trust of the American people in their government being at an all-time low. Three 2015 Gallup polls said that 75 percent of respondents believed corruption is widespread in government and its regulation of business. One would think the freedom from corruption charge should have fallen.

Government Size

High tax rates are killing the U.S. economy! For reasons why, see the post The Rahn Curve, Hauser’s Law, The Laffer Curve and Flat Taxes The top individual tax rate is 39.6 percent, and as I have bewailed many times before, we have the highest corporate tax rates in the world, with the exception of Chad and the United Arab Emirates. When state and local taxes on corporations are added to federal corporate taxes, the top corporate tax rate is 35 percent. Total government spending (federal, state and local) amounts to around 39 percent of GDP. Nevertheless, until recently sequestration has kept spending relatively constant, a situation which is rapidly changing. For this reason the government spending score rose to a still miserably low 54.7, while the fiscal freedom score with the effects of high tax rates fell to 65.6.

Regulatory Efficiency

Starting with the advent of the first Obama administration, more than 180 major new federal regulations have burdened businesses with an additional estimated annual cost of $80 billion. This has caused the business freedom score to fall to 84.7. Growth in employment opportunities has been restricted by such government policies as excessive occupational licensing and rises in minimum wages. This has caused the labor freedom score to fall to 91.4, which is still a respectably high number. The bad effects of the Federal Reserve’s monetary policy, however, is essentially hidden from the monetary freedom score, since it has resulted in neither high inflation nor deflation. The real damage of the monetary policy has been in destroying total savings and in inflating asset bubbles, such as in real estate (remember the 2007-2008 financial crisis?) and in the stock market. Because these damaging effects of monetary policy are hidden from the scoring apparatus, lacking either inflation or deflation, the monetary freedom score rose to 77.0.

Open Markets

With high tariffs (average U.S. tariff is 1.5 percent) increasing the cost of imports, especially on clothing, and with the non-tariff barriers (NTBs) of restricted sugar imports and the mandates for the use of domestically built ships for domestic maritime traffic, it is surprising the trade freedom score is as large as it is. This score has remained constant at 87.0. However the election of either Hillary Clinton or Donald Trump should cause downward pressure on it.

The financial “reforms” of the Dodd-Frank Act of 2010 have increased costs and uncertainty for investors, and especially for small businesses and small community banks. Nevertheless, this major damage was created about six years ago, so both the investment freedom and financial freedom scores have held constant at a low 70.0.

The Final Result

Looking over the scores of the various factors, it rapidly becomes apparent where the government is hurting us the most is in high government expenditures and taxes. Sequestration kept the already low government spending score from sinking any further, but as the Congressional Budget Office (CBO) has just informed us in their annual budget and economic outlook report, the budget deficit will again begin to rise this year. Just as surely, the government spending score will sink ever further into the abyss. Taxes, while hurting individuals, are hurting businesses even more, especially the multinational corporations. The high taxes, together with our world-wide tax regime, are making our companies non-competitive with foreign companies, even for business here in the United States. The higher taxes already imposed on us by Obama, and promised to go higher by Hillary Clinton, will certainly limit companies’ capability to create both wealth and new jobs.

After government spending and taxation, the next biggest problem foisted on us by government are the regulations with which it burdens us. If you do not believe the fall in the business freedom score, go ask the coal miners of West Virginia or Kentucky, or the farmers and ranchers of the West fighting the EPA from regulating them out of existence. In addition, the regulations from the misnamed Affordable Care Act, AKA Obamacare, are hurting family budgets and medical insurance companies everywhere,

Another example of government regulation that hurts both the freedom to invest and financial freedom is the Dodd-Frank Act, which limits the ability of banks to give loans to any but their most credit-worthy customers. Between the low interest rates imposed by the Federal Reserve and the Dodd-Frank regulations, banks in general and small community banks in particular are finding it hard to make a profit, or in some cases even to survive.

One factor in the index of economic freedom that actually underestimates harm done by the government is the monetary freedom factor. The score for it is supposed to measure freedom from the bad effects of inflation/deflation and from price controls. Other bad effects of government monetary policy are the discouragement of savings — from which all investment arises — and the inflation of asset balloons.

All of this is what the scores for the various components of the index of economic freedom are telling us. May God continue to watch over children, fools, and the United States of America!

Views: 3,851