A Closer Look at the Index of Economic Freedom

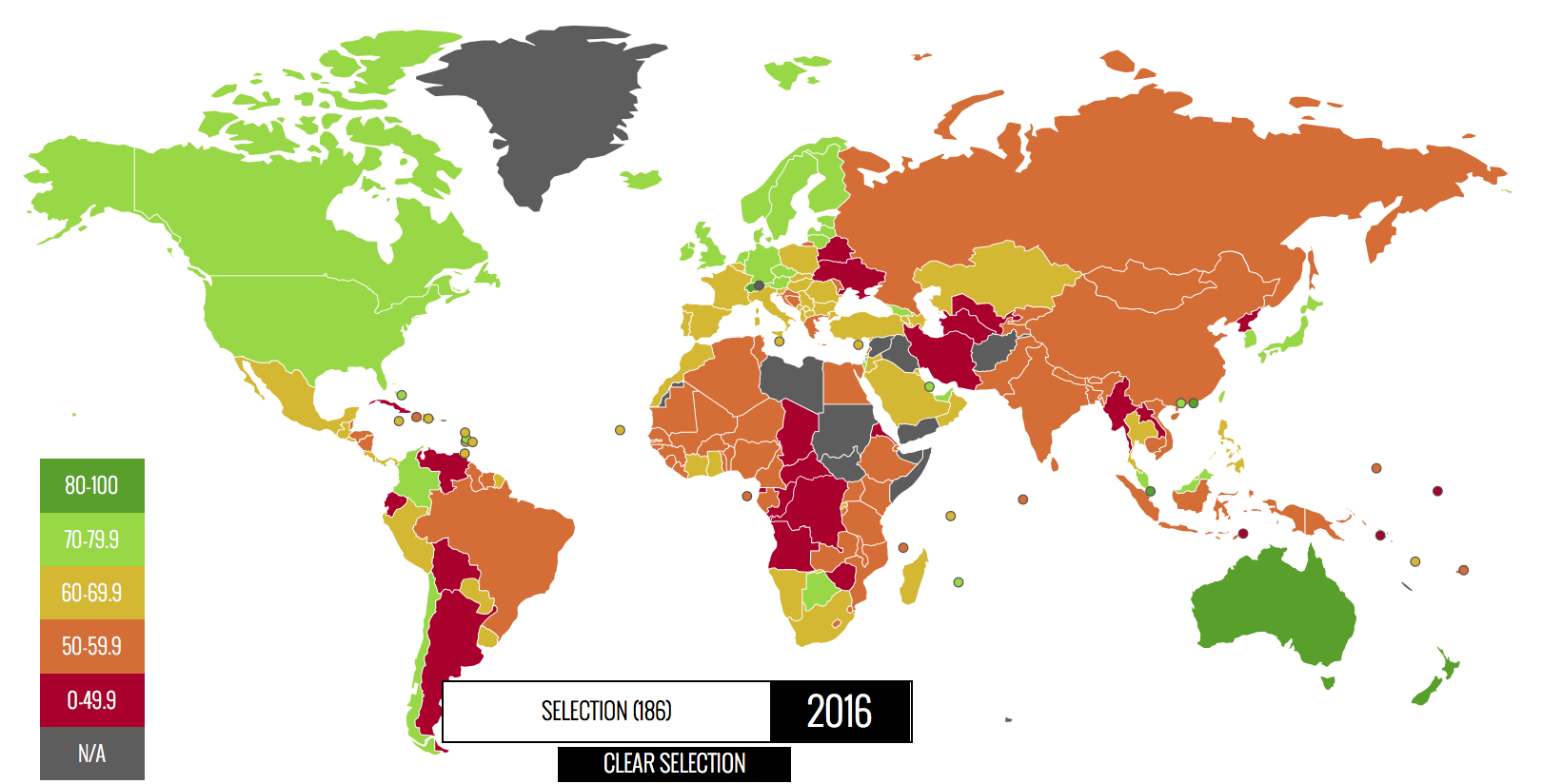

World Map of the WSJ/Heritage Foundation Index of Economic Freedom

Image Credit: Heritage Foundation

In a number of posts I have used the Wall Street Journal/Heritage Foundation Index of Economic Freedom as a measure of the degree of state intrusion into the economy in each country for which it is calculated. However, questions have been raised about just what it does indicate. A reader wrote the following in a comment to the post Are Leftist Economies Better than Free-Markets:

When I first looked at the index, I thought 3 of the 10 criterion of the WSJ index are not monotonically correlated with less government instrusion in the economy. The first two, and then freedom from inflation/deflation. Looking at it again, I would say that none of the criterion except for, of course, taxes and government size are always monotonically correlated with smaller government, so obviously I think there is a difference between size of government and government’s tendency to intrude in the economy.

In this essay I will look more closely at how the index is calculated, hopefully to remove any questions about what exactly it means.

Country Scoring

What I write here will be a necessarily condensed version of what the Heritage Foundation gives us on their Methodology page for the 2016 Index of Economic Freedom. Their index for a particular country is a straight numerical average, i.e. with equal weighting, of ten factors, which are organized for convenience into four categories of factors. These factors are each scored between 0 and 100, with 0 meaning what the factor would be like in a totalitarian state, and 100 denoting a completely free, laissez-faire economy. Some factors are scored qualitatively, with the scores for everything between totalitarian state and laissez-faire economy prescribed by detailed qualitative descriptions of the environment. Scores for most of the factors are more quantitative in their definition. The categories and their constituent factors are:

- Rule of Law

- Property Rights

- Freedom from corruption

- Government Size

- Fiscal Freedom from taxes

- Government Size/Spending

- Regulatory Efficiency

- Business Freedom from Regulations

- Labor Freedom from Regulations

- Monetary Freedom from Inflation/Deflation

- Open Markets

- Trade Freedom from tariffs and non-tariff barriers to international trade.

- Investment Freedom from restrictions on the movement and use of investment capital.

- Financial Freedom from government control and interference in the financial sector, including banks.

We will next go through each of the scored factors to precisely define how they are scored. After that I will give some concluding remarks on the meaning of the index score for an individual country.

Property Rights

This score is constructed with the attitude that the more restrictions the state puts on individuals and companies to accumulate and use private property, the lower the score should be. The property rights factor is an example of one that is qualitatively scored. Quoting verbatim from the Heritage Foundation’s Methodology page, the scores for various economic environments are assigned as follows:

- 100: Private property is guaranteed by the government. The court system enforces contracts efficiently and quickly. The justice system punishes those who confiscate private property unlawfully. There is no corruption or expropriation.

- 90: Private property is guaranteed by the government. The court system enforces contracts efficiently. The justice system punishes those who confiscate private property unlawfully. Corruption is nearly nonexistent, and expropriation is highly unlikely.

- 80: Private property is guaranteed by the government. The court system enforces contracts efficiently but with some delays. Corruption is minimal, and expropriation is highly unlikely.

- 70: Private property is guaranteed by the government. The court system is subject to delays and lax in enforcing contracts. Corruption is possible but rare, and expropriation is unlikely.

- 60: Enforcement of property rights is lax and subject to delays. Corruption is possible but rare, and the judiciary may be influenced by other branches of government. Expropriation is unlikely.

- 50: The court system is inefficient and subject to delays. Corruption may be present, and the judiciary may be influenced by other branches of government. Expropriation is possible but rare.

- 40: The court system is highly inefficient, and delays are so long that they deter resort to the courts. Corruption is present, and the judiciary is influenced by other branches of government. Expropriation is possible.

- 30: Property ownership is weakly protected. The court system is highly inefficient. Corruption is extensive, and the judiciary is strongly influenced by other branches of government. Expropriation is possible.

- 20: Private property is weakly protected. The court system is so inefficient and corrupt that outside settlement and arbitration is the norm. Property rights are difficult to enforce. Judicial corruption is extensive. Expropriation is common.

- 10:Private property is rarely protected, and almost all property belongs to the state. The country is in such chaos (for example, because of ongoing war) that protection of property is almost impossible to enforce. The judiciary is so corrupt that property is not protected effectively. Expropriation is common.

- 0: Private property is outlawed, and all property belongs to the state. People do not have the right to sue others and do not have access to the courts. Corruption is endemic.

If those doing the scoring feel the situation is such that a country is in-between two described environments, say the one given a score of 40 and the one awarded a score of 50, they will split the difference and give it a score of 45. If you go through the environments from 0 to 100, you can verify increasing scores label economies with decreasing state intrusion into property rights.

Clearly, since a qualitative judgement must be made on just which of these environments a country possesses, there might be some human error in choosing it. On the other hand, each environment is extensively described, which limits any error.

Freedom from Corruption

This score is directly taken from Transparency International’s Corruption Perceptions Index (CPI), which is scaled from 0 for highly corrupt to 100 for very clean. For countries not covered by the CPI, the Heritage Foundation determines the score from qualitative information from ” internationally recognized and reliable sources.”

The big connection between this factor and state intervention in the economy is two-fold. First, in situations where the government makes all the important economic decisions, corruption of government officials taking illicit income from the economy can lessen assets for investment, misallocate assets to enterprises not producing the most needed products, and lessen the income of others, Secondly, government cooperation with crony capitalists can lead to exactly the same problems.

Fiscal Freedom from Taxes

A country can not be economically free if the state determines how all the GDP is to be allocated. Therefore, the larger the percentage of the GDP swallowed up by government one way or another, the less assets will be available to private individuals for their own purposes. Not only does the absolute level of taxes matter, but so is the way taxes are distributed across society. If the tax structure discourages corporate investments, it discourages future economic growth, the creation of new jobs, and the raising of wages. Therefore to calculate the score for this factor, scores are calculated for three sub factors:

- f1 = The top marginal tax rate on individual income in per cent.

- f2 = The top marginal tax rate on corporate income in percent

- f3 = The total tax burden as a percentage of GDP

As you can see from their definitions, the fi reach a maximum of 100 exactly when state intrusion in the economy is maximal, which is the opposite of what we desire. The sub-factor scores, Fi, are taken from a quadratic cost function formula, according to

where the coefficient α is taken to be 0,03. The minimum floor for Fi, should the formula give a negative number, is zero.

The final fiscal freedom score is taken as the numerical average of all the Fi.

Government Spending

What government finally does with taxes most of the time is to spend the raised revenues. In fact to impose an economic burden on the country (as opposed to a financial burden caused by levying taxes), the government must spend the tax revenues on the projects of its choosing, In taxing, the government accumulates claims on the economic wealth of the nation; but in spending it the government uses those claim-checks on wealth to allocate economic capital according to its wishes. Should the government spend all of the GDP in a totalitarian state, we want the factor score to be zero; if the government is nonexistent and spends nothing, we desire the score to be 100. If E is the total government expenditures in per cent of GDP, and G is the country’s government spending score, then we again use a quadratic cost function to define

where the coefficient α is taken to be 0.03. As with the sub-factor scores for tax rates, the government spending score is never allowed to go below zero.

Business Freedom from Regulation

The business freedom factor score is a measure of how much government regulatory and infrastructure environments discourage the efficient operation of business. The score will vary from 0 to 100 with 100 denoting the freest business environment. It is an equally weighted average of 13 sub-factors, which measure the ease of starting, operating, and closing a business. These are listed below.

- The number of government mandated procedures that must be followed to start a business.

- The average number of days needed to meet government requirements to start a business.

- The average cost as a percent of income per capita to start a business.

- The number of procedures needed to obtain a license.

- The average cost as a percent of income per capita to obtain a license.

- The average time in years required to close a business.

- The cost as a percent of the estate to close the business

- The rate of recovery of the book value of the business in cents on the dollar on closing the business

- The number of procedures required to get electricity.

- The number of days required to get electricity.

- The cost as a percent of income per capita of getting electricity.

Now, these sub-factors, measured either as periods of time or as costs in some units, are given in incommensurate units. Also they all increase as government economic intrusion increases, rather than decrease as we need. The Heritage Foundation gets around this problem as follows. Let us say that the ith sub-factor in the list above is fi . Then having all of these sub-factors for all of the nations in the ensemble, we can easily calculate an average for all the sub-factors. Let us denote the average of the ith sub-factor as 〈fi〉. If this sub-factor for a particular country is below the international average, we want the score to be above 50; if it is above the international average, we want the sub-factor score to be below 50. This can be arranged by defining the sub-factor score, Fi, to be Fi = 50〈fi〉/ fi.

The sub-factor score is limited to a maximum of 100 (as if any economy could reach such heights). The over-all business freedom factor score is then a straight numerical average of the 13 Fi with the desired variation of 0 for the least free and 100 for the most free.

Labor Freedom

The labor freedom score is similar in construction to that of the business freedom score since it has the same problems. There are seven quantitative sub-factors listed below.

- Ratio of minimum wage to the average value added per worker,

- Hindrance to hiring additional workers,

- Rigidity of hours,

- Difficulty of firing redundant employees,

- Legally mandated notice period,

- Mandatory severance pay

- Labor force participation rate

The sub-factor scores are then converted to a scale from 0 to100 in the same way as with the business freedom sub-factors, using the formula Fi = 50〈fi〉/ fi. The total labor freedom score is then an average of the seven sub-factor scores.

Monetary Freedom

This factor combines a measure of price stability together with a penalty for any price controls. Therefore there are two sub-factors:

- The weighted average inflation rate for the most recent three years.

- Price controls.

The Heritage Foundation is not too specific on how it scores price controls, other than to say “the price control (PC) penalty is an assigned value of 0–20 penalty points based on the extent of price controls.” Clearly zero (no penalty) would be assigned for no price controls, and 20 for the most onerous price controls; how this is assessed is not explained. We will denote the penalty points with P.

The weighted average inflation, which we will denote with I, is calculated according to the formula

I = θ1 It + θ2 It-1 + θ3 It-2

where It is the absolute value of the inflation rate, as measured by the Consumer Price Index during year t. That is, if there is deflation and the inflation rate is negative, deflation is counted just as deleterious to the economy as a similar amplitude of positive inflation. (I can hear the Keynesians howling with outrage now!) The weights θ1, θ2, and θ3 add up to one and are in order exponentially smaller. The values chosen are 0.665, 0.245, and 0.090, respectively, With these values more recent inflation is weighted more heavily.

Given the sub-factors I and P, the monetary freedom score M for a particular country is given by

M = 100 – α √I – P

The coefficient α is a number chosen to stabilize the variance of scores. If there are no price control penalty points, its value of 6.333 converts a 10 percent inflation/deflation rate into a freedom score if 80.0 and a 2 percent inflation rate into a score of 91.0. The square root is taken of the weighted inflation rate to put more discrimination between countries with hyperinflation.

Since inflation and price controls cause a decrease in the score from the highest value of 100 for the most conceivably free nation, the existence of either government caused inflation or price controls decreases its monetary freedom score.

Trade Freedom

Governments can harm international trade with their country by either imposing tariffs or non-tariff barriers (NTBs), which are the two sub-factors for this factor score. More often than not, imports entering a country are charged different tariffs, depending on what the import is. As a result the Heritage Foundation uses a weighted average tariff to calculate the trade freedom score FT. The weights for the average are set based on the share of all imports for each good. The minimum tariff is naturally zero percent, and an upper bound for it was set at 50 precent. (What country would be so out of its mind it would set such a confiscatory minimum tariff!)

If Tmax and Tmin are the maximum and minimum tariff rates for goods entering a country, T is the weighted average tariff, and N is the non-tariff barrier penalty score for the country (discussed shortly), the trade freedom factor score is calculated according to the formula

The more tariffs are close to the low end of the spread, the larger the difference of the maximum tariff from the weighted average tariff will tend to be, and the larger the tariff part of the score will be. The NTB penalty subtracted from the base score can be 5, 10, 15, or 20 points according to the following considerations. I quote verbatim from the Heritage Foundation Methodology page:

- 20—NTBs are used extensively across many goods and services and/or act to impede a significant amount of international trade.

- 15—NTBs are widespread across many goods and services and/or act to impede a majority of potential international trade.

- 10—NTBs are used to protect certain goods and services and impede some international trade.

- 5—NTBs are uncommon, protecting few goods and services, and/or have a very limited impact on international trade.

- 0—NTBs are not used to limit international trade.

We determine the extent of NTBs in a country’s trade policy regime using both qualitative and quantitative information. Restrictive rules that hinder trade vary widely, and their overlapping and shifting nature makes their complexity difficult to gauge. The categories of NTBs considered in our penalty include:

- Quantity restrictions—import quotas; export limitations; voluntary export restraints; import–export embargoes and bans; countertrade, etc.

- Price restrictions—antidumping duties; countervailing duties; border tax adjustments; variable levies/tariff rate quotas.

- Regulatory restrictions—licensing; domestic content and mixing requirements; sanitary and phytosanitary standards (SPSs); safety and industrial standards regulations; packaging, labeling, and trademark regulations; advertising and media regulations.

- Customs restrictions—advance deposit requirements; customs valuation procedures; customs classification procedures; customs clearance procedures.

- Direct government intervention—subsidies and other aid; government industrial policies; government-financed research and other technology policies; competition policies; government procurement policies; state trading, government monopolies, and exclusive franchises.

The Heritage Foundation gets its information on tariffs predominantly from the World Bank.

Investment Freedom

If there were complete economic freedom in a country, that country would have no constraints on the flow of investment capital, and would receive a score of 100 for this factor. Unfortunately, most countries will have rules on how capital can be invested, many times with the rules being different for domestic investments and foreign investments. Often some industries are closed to foreign investment. There can be restrictions on access to foreign exchange, payments, transfers, and capital transactions.

Any restriction on investment freedom is treated as a penalty deduction from a maximum score of 100. There are a few governments that impose so may restrictions the result of subtracting all the penalty points is a negative number. Those countries have the total factor score set to zero. I shamelessly quote the Heritage Foundation Methodology page verbatim for considerations on assessing penalty points:

National treatment of foreign investment

- No national treatment, prescreening 25 points deducted

- Some national treatment, some prescreening 15 points deducted

- Some national treatment or prescreening 5 points deducted

Foreign investment code

- No transparency and burdensome bureaucracy 20 points deducted

- Inefficient policy implementation and bureaucracy 10 points deducted

- Some investment laws and practices non-transparent

or inefficiently implemented 5 points deducted

Restrictions on land ownership

- All real estate purchases restricted 15 points deducted

- No foreign purchases of real estate 10 points deducted

- Some restrictions on purchases of real estate 5 points deducted

Sectoral investment restrictions

- Multiple sectors restricted 20 points deducted

- Few sectors restricted 10 points deducted

- One or two sectors restricted 5 points deducted

Expropriation of investments without fair compensation

- Common with no legal recourse 25 points deducted

- Common with some legal recourse 15 points deducted

- Uncommon but occurs 5 points deducted

Foreign exchange controls

- No access by foreigners or residents 25 points deducted

- Access available but heavily restricted 15 points deducted

- Access available with few restrictions 5 points deducted

Capital controls

- No repatriation of profits; all transactions require

government approval 25 points deducted - Inward and outward capital movements require

approval and face some restrictions 15 points deducted - Most transfers approved with some restrictions 5 points deducted

Up to an additional 20 points may be deducted for security problems, a lack of basic investment infrastructure, or other government policies that indirectly burden the investment process and limit investment freedom.

Financial Freedom

The score for this factor is a measure both of banking efficiency and independence from government control and interference. In a completely free banking and financial environment there will be a minimal level of government control and interference. Five broad areas of banking and financial activity are examined to determine the over-all score, From the Heritage Foundation Methodology page, these are:

- The extent of government regulation of financial services,

- The degree of state intervention in banks and other financial firms through direct and indirectownership,

- Government influence on the allocation of credit,

- The extent of financial and capital market development, and

- Openness to foreign competition.

As with the score for property rights, qualitative considerations are used to assign scores. Scores are assigned according to the following considerations, taken again verbatim from the Heritage Foundation Methodology page.

- 100—Negligible government interference.

- 90—Minimal government interference. Regulation of financial institutions is minimal but may extend beyond enforcing contractual obligations and preventing fraud.

- 80—Nominal government interference. Government ownership of financial institutions is a small share of overall sector assets. Financial institutions face almost no restrictions on their ability to offer financial services.

- 70—Limited government interference. Credit allocation is influenced by the government, and private allocation of credit faces almost no restrictions. Government ownership of financial institutions is sizeable. Foreign financial institutions are subject to few restrictions.

- 60—Moderate government interference. Banking and financial regulations are somewhat burdensome. The government exercises ownership and control of financial institutions with a significant share of overall sector assets. The ability of financial institutions to offer financial services is subject to some restrictions.

- 50—Considerable government interference. Credit allocation is significantly influenced by the government, and private allocation of credit faces significant barriers. The ability of financial institutions to offer financial services is subject to significant restrictions. Foreign financial institutions are subject to some restrictions.

- 40—Strong government interference. The central bank is subject to government influence, its supervision of financial institutions is heavy-handed, and its ability to enforce contracts and prevent fraud is weak. The government exercises active ownership and control of financial institutions with a large minority share of overall sector assets.

- 30—Extensive government interference. Credit allocation is influenced extensively by the government. The government owns or controls a majority of financial institutions or is in a dominant position. Financial institutions are heavily restricted, and bank formation faces significant barriers. Foreign financial institutions are subject to significant restrictions.

- 20—Heavy government interference. The central bank is not independent, and its supervision of financial institutions is repressive. Foreign financial institutions are discouraged or highly constrained.

- 10—Near repressive. Credit allocation is controlled by the government. Bank formation is restricted. Foreign financial institutions are prohibited.

- 0—Repressive. Supervision and regulation are designed to prevent private financial institutions from functioning. Private financial institutions are nonexistent.

Meaning of the Index of Economic Freedom

The overall Index of Economic Freedom is a simple arithmetic average of the 10 component factors, each of which varies from 0 with the most completely repressive government control of that factor, to 100 when that factor is as free from government interference as conceivably possible. The final index is then an average of the freedom of all the economic factors from government control. If you look back at how the scores from all the individual factors are constructed, not a single one can fail to diminish with increasing government control!

To be sure, one country with a larger index value than another can have greater government control of a particular factor, so long as the penalty it pays in the index for that factor is balanced by being even better in other factors. Overall, the country with the higher index must be the more economically free, I intend to use it a lot in the future to compare different countries.

Views: 2,474