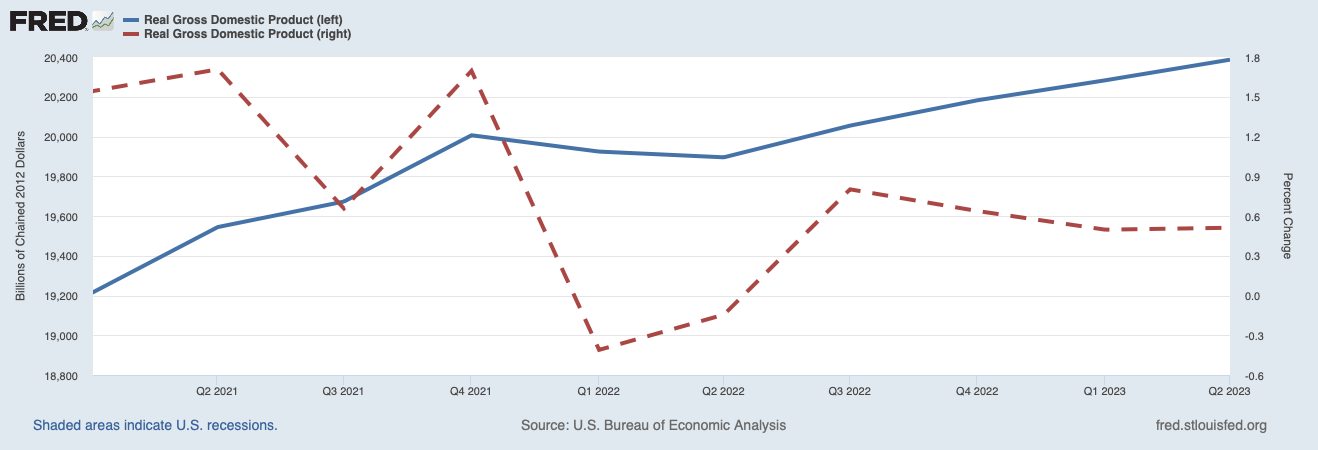

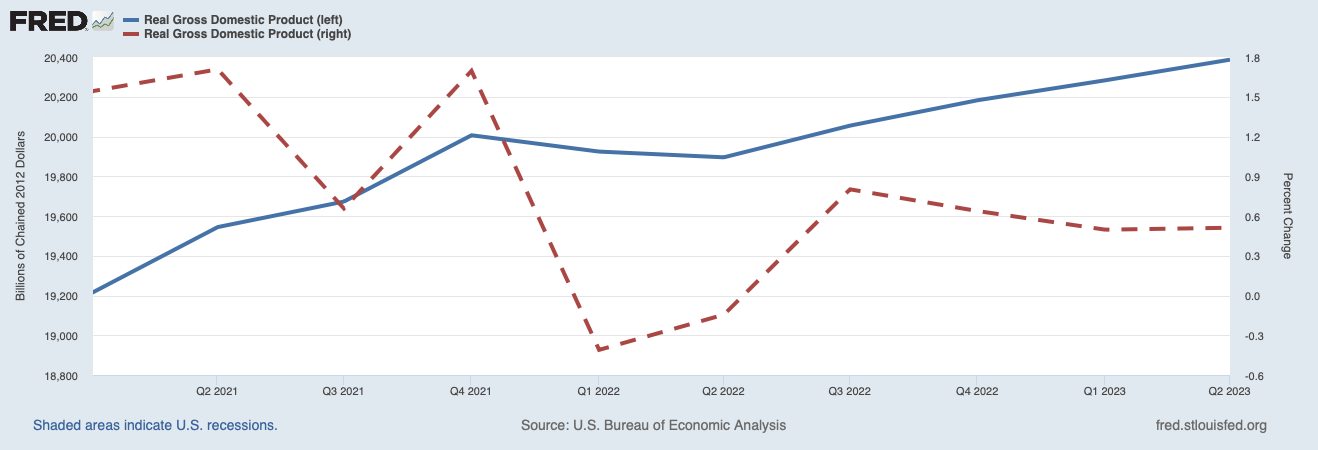

Coincident Economic Indicators

Real GDP (blue curve) and its percentage change from the previous quarter (dashed red line) --- St. Louis Federal Reserve District Bank

"There are more things in Heaven and Earth, Horatio, than are dreamt of in your philosophy."